## Loading required package: ggplot2

## Loading required package: gridExtra

## Loading required package: reshape2

## Loading required package: VineCopula

## Loading required package: randtoolbox

## Loading required package: rngWELL

## This is randtoolbox. For an overview, type 'help("randtoolbox")'.

##

##

## This is version 1.3.0 of esgtoolkit. Starting with 1.0.0, package renamed as: 'esgtoolkit' (lowercase)

##

##

# Spot variance

V0 <- 0.1372

# mean-reversion speed

kappa <- 9.5110/100

# long-term variance

theta <- 0.0285

# volatility of volatility

volvol <- 0.8010/100

# Correlation between stoch. vol and prices

rho <- -0.5483

# Intensity of the Poisson process

lambda <- 0.3635

# mean and vol of the merton jumps diffusion

mu_J <- -0.2459

sigma_J <- 0.2547/100

m <- exp(mu_J + 0.5*(sigma_J^2)) - 1

# Initial stock price

S0 <- 4468.17

# Initial short rate

r0 <- 0.0357

# ============================================================================

# SIMULATION SETUP

# ============================================================================

n <- 300

horizon <- 1

freq <- "weekly"

start_ <- start(EuStockMarkets)

end_ <- end(EuStockMarkets)

print(end_ - start_)

## [1] 7 39

freq_ <- frequency(EuStockMarkets)

# Simulation of shocks, with antithetic variates

shocks <- esgtoolkit::simshocks(n = n,

horizon = 8L,

method = "anti",

family = 1, par = rho,

start = start_, frequency=freq_)

print(start_)

## [1] 1991 130

## [1] 260

## [1] 1998 169

## [1] 1991 130

## [1] 260

## [1] 1999 129

============================================================================

VOLATILITY SIMULATION (CIR PROCESS)

============================================================================

# Vol simulation

sim_vol <- esgtoolkit::simdiff(n = n,

model = "CIR", x0 = V0,

theta1 = kappa*theta, theta2 = kappa,

theta3 = volvol,

eps = shocks[[1]],

start = start_,

frequency=freq_,

horizon = 8L)

print(start(sim_vol))

## [1] 1991 130

## [1] 260

## [1] 1999 130

============================================================================

ASSET PRICE SIMULATION (GBM WITH JUMPS)

============================================================================

# prices simulation

sim_price <- esgtoolkit::simdiff(n = n, start = start_,

end = end_,

frequency=freq_,

horizon = 8L,

model = "GBM", x0 = S0,

theta1 = r0 - lambda*m, theta2 = sim_vol,

lambda = lambda, mu_z = mu_J,

sigma_z = sigma_J,

eps = shocks[[2]])

print(start(sim_price))

## [1] 1991 130

## [1] 260

## [1] 1998 169

## [1] 1860 300

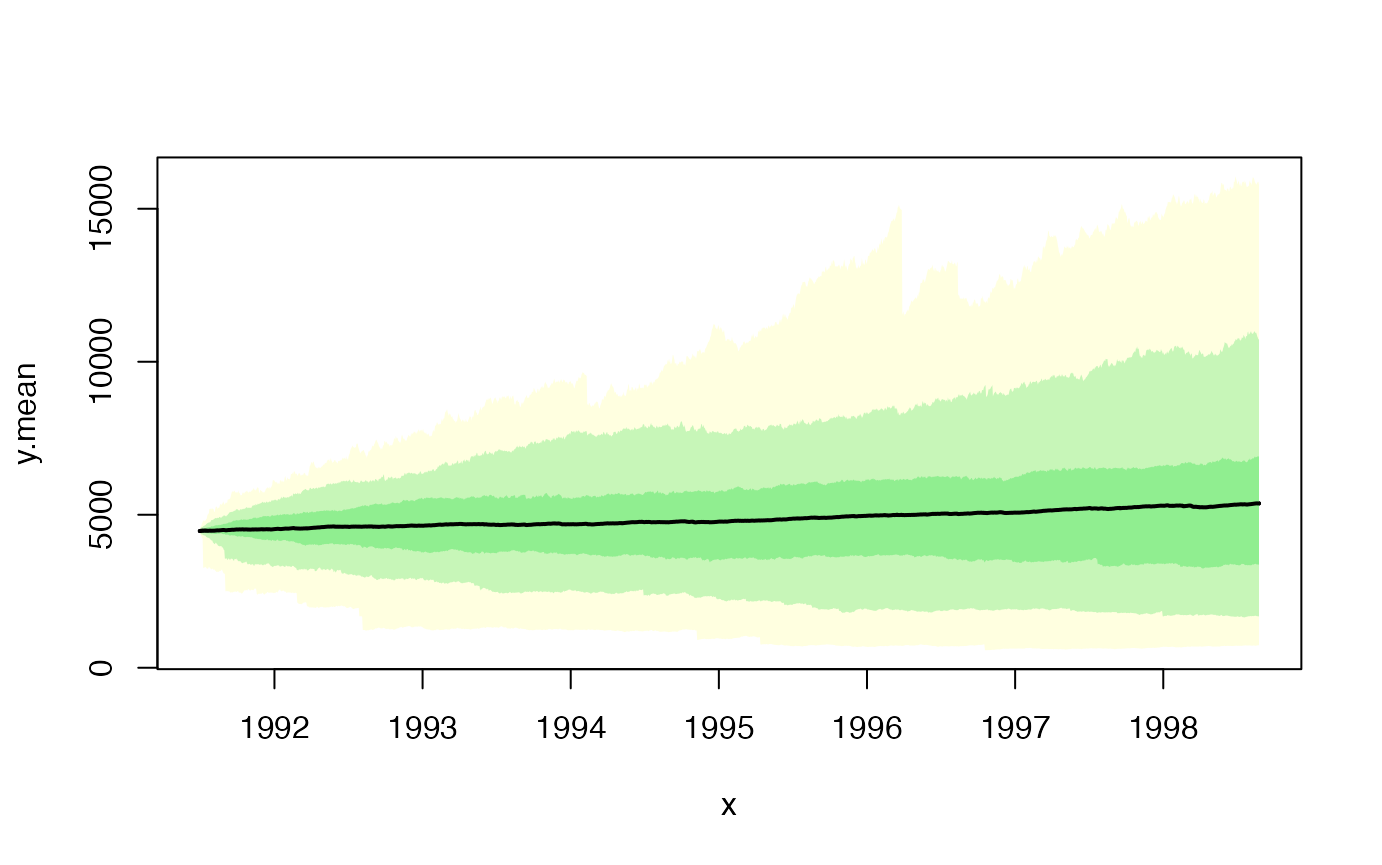

# Plot the simulated price paths

esgtoolkit::esgplotbands(sim_price)