rm(list=ls()) # beware, removes everything in your environment

library(esgtoolkit)## Loading required package: ggplot2## Loading required package: gridExtra## Loading required package: reshape2## Loading required package: VineCopula## Loading required package: randtoolbox## Loading required package: rngWELL## This is randtoolbox. For an overview, type 'help("randtoolbox")'.## Loading required package: zoo##

## Attaching package: 'zoo'## The following objects are masked from 'package:base':

##

## as.Date, as.Date.numeric## Loading required package: data.table##

## Attaching package: 'data.table'## The following objects are masked from 'package:zoo':

##

## yearmon, yearqtr## The following objects are masked from 'package:reshape2':

##

## dcast, melt##

##

## This is version 1.10.0 of esgtoolkit. Starting with 1.0.0, package renamed as: 'esgtoolkit' (lowercase)

##

##

# Observed maturities

u <- 1:30

# Yield to maturities

txZC <- c(0.01422,0.01309,0.01380,0.01549,0.01747,0.01940,

0.02104,0.02236,0.02348, 0.02446,0.02535,0.02614,

0.02679,0.02727,0.02760,0.02779,0.02787,0.02786,

0.02776,0.02762,0.02745,0.02727,0.02707,0.02686,

0.02663,0.02640,0.02618,0.02597,0.02578,0.02563)

# discount factors

p <- c(0.9859794,0.9744879,0.9602458,0.9416551,0.9196671,

0.8957363,0.8716268,0.8482628,0.8255457,0.8034710,

0.7819525,0.7612204,0.7416912,0.7237042,0.7072136

,0.6922140,0.6785227,0.6660095,0.6546902,0.6441639,

0.6343366,0.6250234,0.6162910,0.6080358,0.6003302,

0.5929791,0.5858711,0.5789852,0.5722068,0.5653231)

# Creating a function for the simulation of G2++

# Function of the number of scenarios, the method (

# antithetic or not)

simG2plus <- function(n, methodyc = c("fmm", "hyman", "HCSPL", "SW"))

{

# Horizon, number of simulations, frequency

horizon <- 20

freq <- "semi-annual"

delta_t <- 1/2

# Parameters found for the G2++

a_opt <- 0.50000000

b_opt <- 0.35412030

sigma_opt <- 0.09416266

rho_opt <- -0.99855687

eta_opt <- 0.08439934

# Simulation of gaussian correlated shocks

eps <- esgtoolkit::simshocks(n = n, horizon = horizon,

frequency = "semi-annual",

family = 1, par = rho_opt)

# Simulation of the factor x

x <- esgtoolkit::simdiff(n = n, horizon = horizon,

frequency = freq,

model = "OU",

x0 = 0, theta1 = 0, theta2 = a_opt, theta3 = sigma_opt,

eps = eps[[1]])

# Simulation of the factor y

y <- esgtoolkit::simdiff(n = n, horizon = horizon,

frequency = freq,

model = "OU",

x0 = 0, theta1 = 0, theta2 = b_opt, theta3 = eta_opt,

eps = eps[[2]])

# Instantaneous forward rates, with spline interpolation

methodyc <- match.arg(methodyc)

fwdrates <- esgtoolkit::esgfwdrates(n = n, horizon = horizon,

out.frequency = freq, in.maturities = u,

in.zerorates = txZC, method = methodyc)

fwdrates <- window(fwdrates, end = horizon)

# phi

t.out <- seq(from = 0, to = horizon,

by = delta_t)

param.phi <- 0.5*(sigma_opt^2)*(1 - exp(-a_opt*t.out))^2/(a_opt^2) +

0.5*(eta_opt^2)*(1 - exp(-b_opt*t.out))^2/(b_opt^2) +

(rho_opt*sigma_opt*eta_opt)*(1 - exp(-a_opt*t.out))*

(1 - exp(-b_opt*t.out))/(a_opt*b_opt)

param.phi <- ts(replicate(n, param.phi),

start = start(x), deltat = deltat(x))

phi <- fwdrates + param.phi

colnames(phi) <- c(paste0("Series ", 1:n))

# The short rates

r <- x + y + phi

colnames(r) <- c(paste0("Series ", 1:n))

return(r)

}

set.seed(3)

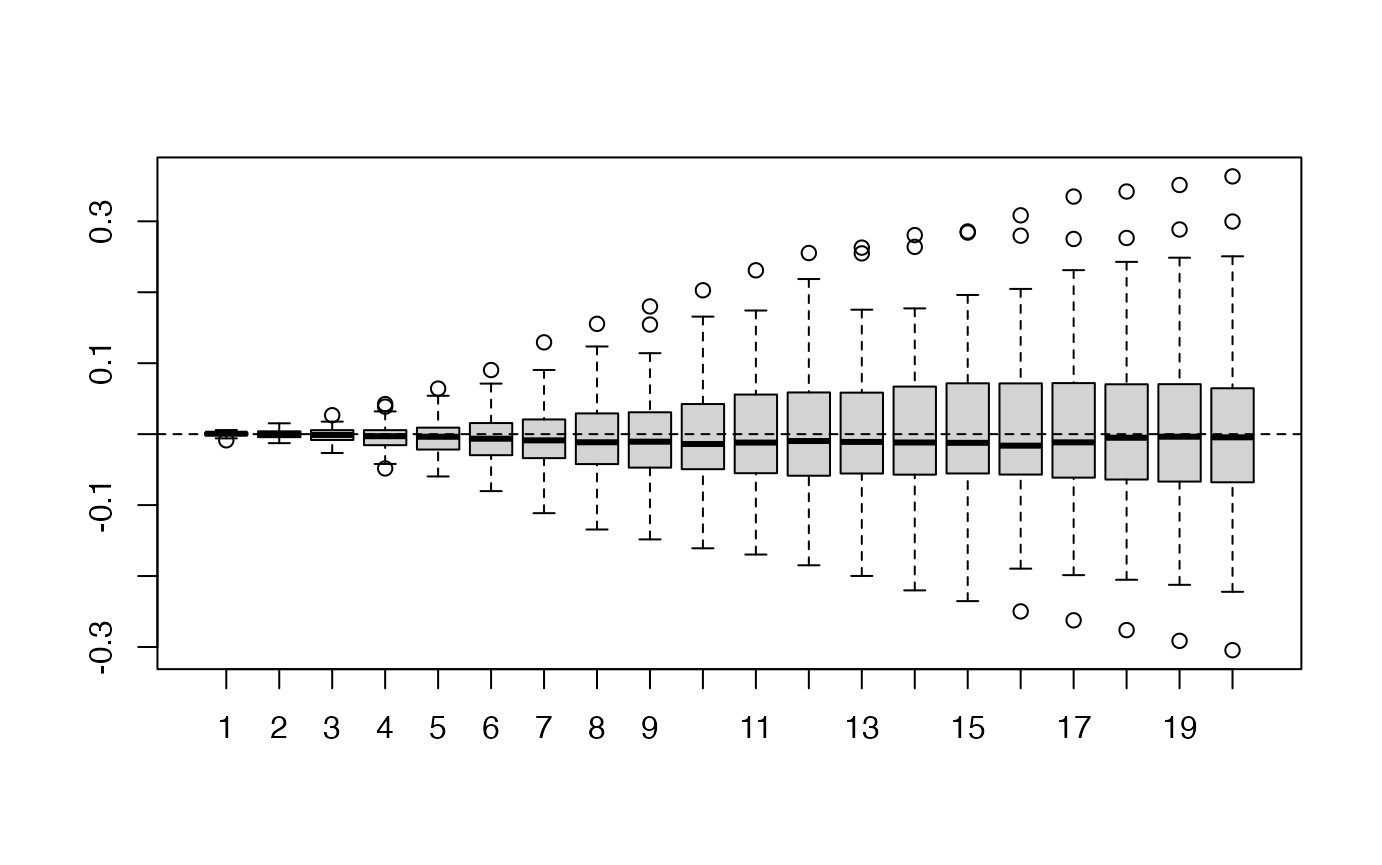

# 4 types of simulations, by changing the number of scenarios

ptm <- proc.time()

r_SW <- simG2plus(n = 100, methodyc = "hyman")

proc.time() - ptm## user system elapsed

## 0.313 0.034 1.199

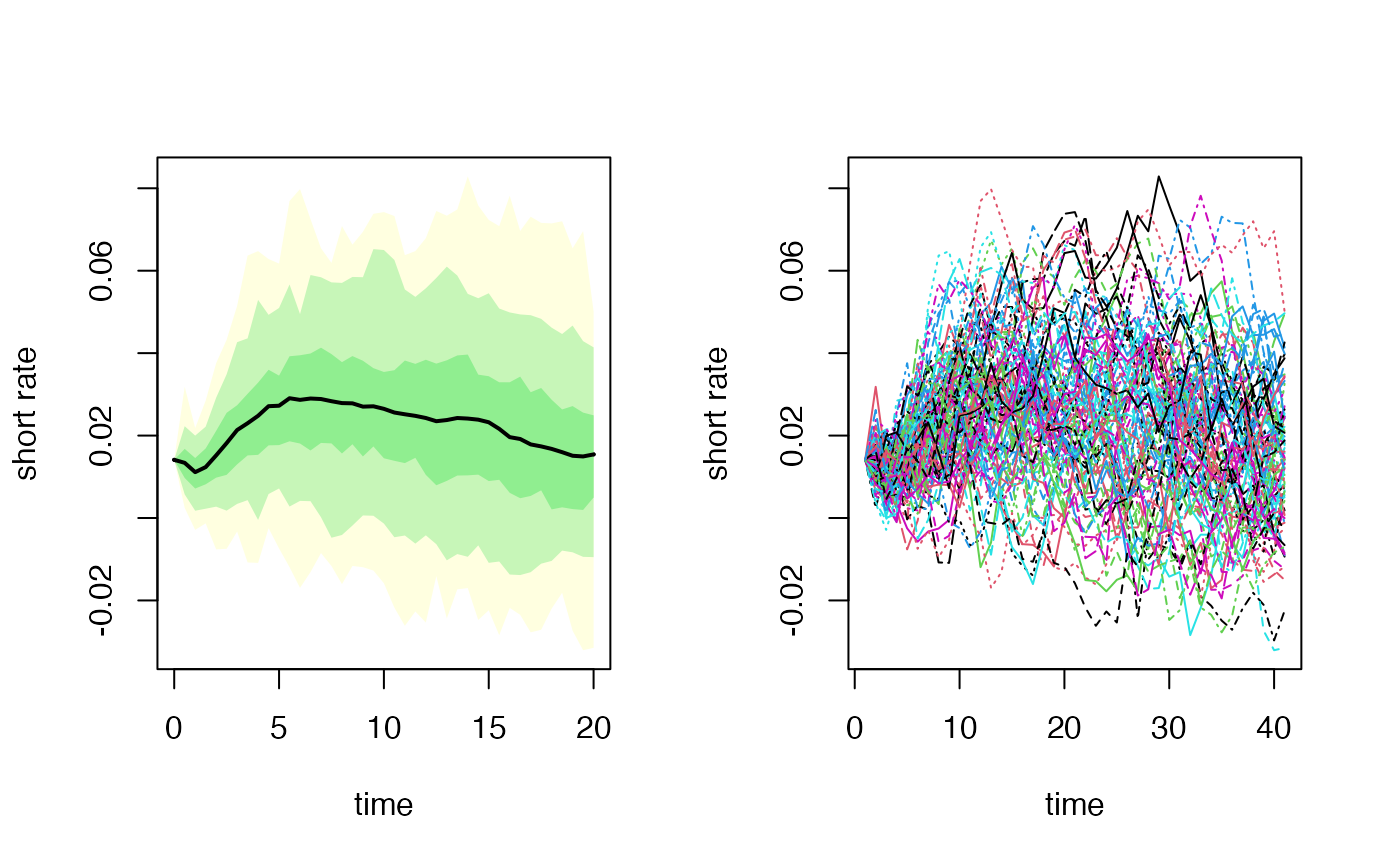

par(mfrow=c(1, 2))

esgtoolkit::esgplotbands(r_SW, xlab = 'time', ylab = 'short rate')

matplot(r_SW, type = 'l', xlab = 'time', ylab = 'short rate')

# Stochastic deflators :

deltat_r <- deltat(r_SW)

Dt_SW <- esgtoolkit::esgdiscountfactor(r = r_SW, X = 1)

Dt_SW <- window(Dt_SW, start = deltat_r, deltat = 2*deltat_r)

# Market prices

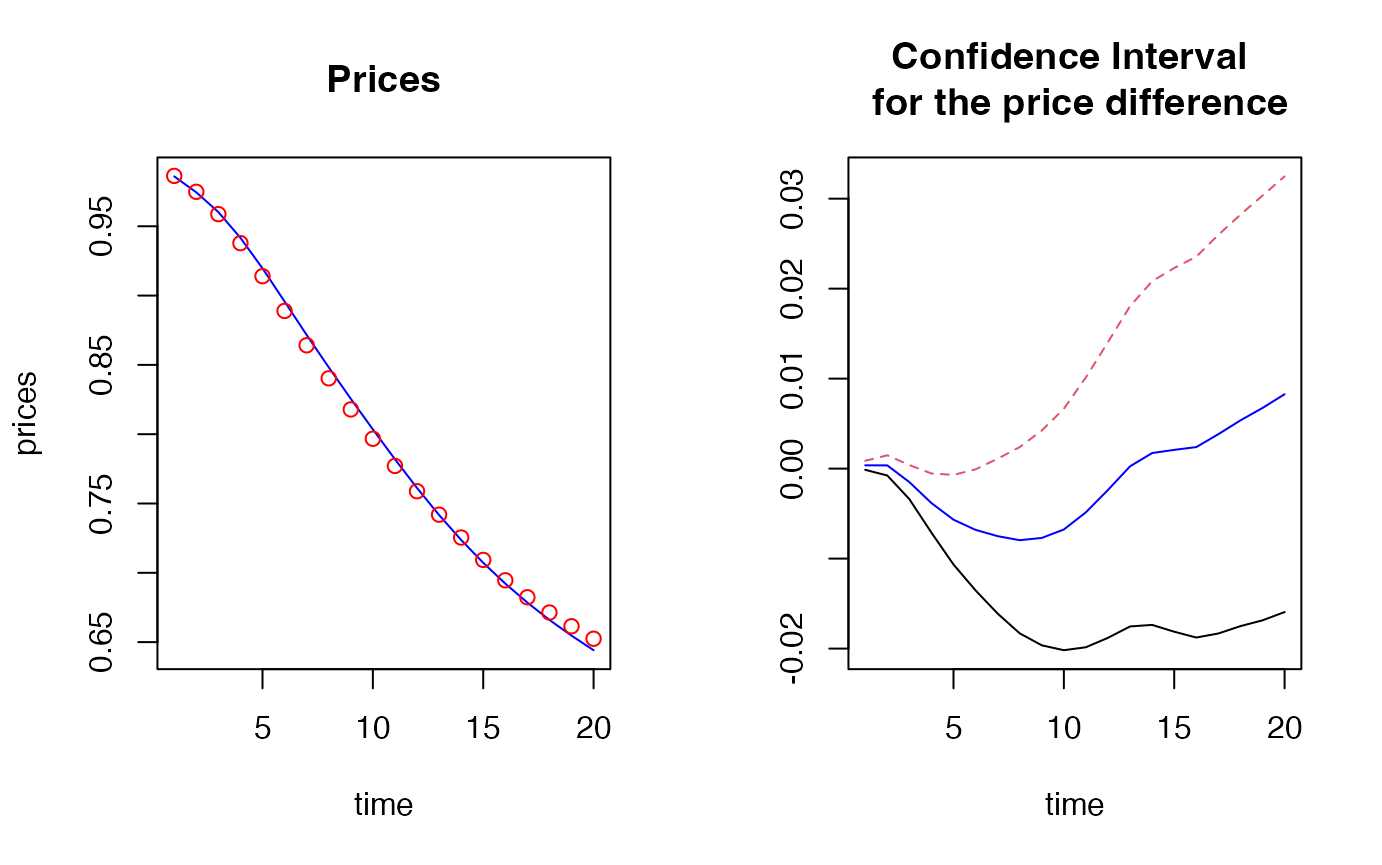

horizon <- 20

marketprices <- p[1:horizon]

# Monte Carlo prices

montecarloprices_SW <- rowMeans(Dt_SW)

montecarlo_ci <- apply(Dt_SW, 1, function(x) t.test(x)$conf.int)

# Confidence intervals

estim_SW <- apply(Dt_SW - marketprices, 1, function(x) t.test(x)$estimate)

conf_int_SW <- apply(Dt_SW - marketprices, 1, function(x) t.test(x)$conf.int)

conf_int_SW## [,1] [,2] [,3] [,4] [,5]

## [1,] -0.0001349734 -0.0007628051 -0.0033894980 -0.0071161264 -0.01065602

## [2,] 0.0008673602 0.0014803122 0.0003935437 -0.0005401371 -0.00069407

## [,6] [,7] [,8] [,9] [,10]

## [1,] -1.353530e-02 -0.016111367 -0.018305953 -0.019637784 -0.020180168

## [2,] -7.901086e-05 0.001100946 0.002392493 0.004235213 0.006652605

## [,11] [,12] [,13] [,14] [,15] [,16]

## [1,] -0.01985051 -0.01880110 -0.01753889 -0.01736885 -0.01812340 -0.01877207

## [2,] 0.01014880 0.01406453 0.01805547 0.02082604 0.02229272 0.02355296

## [,17] [,18] [,19] [,20]

## [1,] -0.01832062 -0.01750398 -0.01686035 -0.01594044

## [2,] 0.02597545 0.02822546 0.03034067 0.03247473

par(mfrow=c(1, 2))

plot(marketprices, col = "blue", type = 'l',

xlab = "time", ylab = "prices", main = "Prices")

points(montecarloprices_SW, col = "red")

#lines(montecarlo_ci[1, ], color = "red", lty = 2)

#lines(montecarlo_ci[2, ], color = "red", lty = 2)

matplot(t(conf_int_SW), type = "l", xlab = "time",

ylab = "", main = "Confidence Interval \n for the price difference")

lines(estim_SW, col = "blue")

difference <- (Dt_SW - marketprices)test for the “martingale” difference (this implementation is very slow)

## Warning in int_abline(a = a, b = b, h = h, v = v, untf = untf, ...): "color" is

## not a graphical parameter