For more details (and text), read https://www.researchgate.net/publication/338549100_ESGtoolkit_a_tool_for_stochastic_simulation_v020.

devtools::install_github("cran/fOptions")## Using GitHub PAT from the git credential store.## Downloading GitHub repo cran/fOptions@HEAD## timeDate (4041.110 -> 4051.111) [CRAN]## Installing 1 packages: timeDate## Installing package into '/private/var/folders/cp/q8d6040n3m38d22z3hkk1zc40000gn/T/RtmpXdVV97/temp_libpath156ab2b0994b'

## (as 'lib' is unspecified)##

## The downloaded binary packages are in

## /var/folders/cp/q8d6040n3m38d22z3hkk1zc40000gn/T//RtmpkukX2R/downloaded_packages

## ── R CMD build ─────────────────────────────────────────────────────────────────

## * checking for file ‘/private/var/folders/cp/q8d6040n3m38d22z3hkk1zc40000gn/T/RtmpkukX2R/remotes163a03a251e35/cran-fOptions-6643ac7/DESCRIPTION’ ... OK

## * preparing ‘fOptions’:

## * checking DESCRIPTION meta-information ... OK

## * cleaning src

## * checking for LF line-endings in source and make files and shell scripts

## * checking for empty or unneeded directories

## Omitted ‘LazyData’ from DESCRIPTION

## * building ‘fOptions_3042.86.tar.gz’## Installing package into '/private/var/folders/cp/q8d6040n3m38d22z3hkk1zc40000gn/T/RtmpXdVV97/temp_libpath156ab2b0994b'

## (as 'lib' is unspecified)## Warning in i.p(...): installation of package

## '/var/folders/cp/q8d6040n3m38d22z3hkk1zc40000gn/T//RtmpkukX2R/file163a02a110b1a/fOptions_3042.86.tar.gz'

## had non-zero exit status## Loading required package: ggplot2## Loading required package: gridExtra## Loading required package: reshape2## Loading required package: VineCopula## Loading required package: randtoolbox## Loading required package: rngWELL## This is randtoolbox. For an overview, type 'help("randtoolbox")'.## Loading required package: zoo##

## Attaching package: 'zoo'## The following objects are masked from 'package:base':

##

## as.Date, as.Date.numeric## Loading required package: data.table##

## Attaching package: 'data.table'## The following objects are masked from 'package:zoo':

##

## yearmon, yearqtr## The following objects are masked from 'package:reshape2':

##

## dcast, melt##

##

## This is version 1.10.0 of esgtoolkit. Starting with 1.0.0, package renamed as: 'esgtoolkit' (lowercase)

##

##

# ESGtoolkit R Code Examples

# Source: ESGtoolkit documentation v0.2.0

# ============================================================================

# INSTALLATION

# ============================================================================

# ============================================================================

# BASIC SETUP FOR SIMSHOCKS EXAMPLES

# ============================================================================

# Number of simulations

nb <- 1000

# Number of risk factors

d <- 2

# Number of possible combinations of the risk factors (here : 1)

dd <- d*(d-1)/2

# Family : Gaussian copula

fam1 <- rep(1, dd)

# Correlation coefficients between the risk factors (d*(d-1)/2)

par0_1 <- 0.1

par0_2 <- -0.9

# ============================================================================

# SIMULATING SHOCKS WITH GAUSSIAN COPULA

# ============================================================================

set.seed(2)

# Simulation of shocks for the d risk factors

s0_par1 <- simshocks(n = nb, horizon = 4,

family = fam1, par = par0_1)

s0_par2 <- simshocks(n = nb, horizon = 4,

family = fam1, par = par0_2)

# ============================================================================

# CORRELATION TESTING

# ============================================================================

# Correlation test

esgcortest(s0_par1)## $cor.estimate

## Time Series:

## Start = 1

## End = 4

## Frequency = 1

## [1] 0.02168139 0.13205902 0.10534299 0.06487379

##

## $conf.int

## Time Series:

## Start = 1

## End = 4

## Frequency = 1

## Series 1 Series 2

## 1 -0.040365943 0.08356216

## 2 0.070644283 0.19247635

## 3 0.043634863 0.16625037

## 4 0.002892336 0.12635869

# Visualization of confidence intervals

(test <- esgcortest(s0_par2))## $cor.estimate

## Time Series:

## Start = 1

## End = 4

## Frequency = 1

## [1] -0.9074131 -0.8952288 -0.8982732 -0.9058858

##

## $conf.int

## Time Series:

## Start = 1

## End = 4

## Frequency = 1

## Series 1 Series 2

## 1 -0.9177781 -0.8958125

## 2 -0.9068912 -0.8821958

## 3 -0.9096129 -0.8855961

## 4 -0.9164143 -0.8941044

#par(mfrow=c(2, 1))

#esgplotbands(esgcortest(s0_par1))

#esgplotbands(test)

# ============================================================================

# CLAYTON COPULA EXAMPLES

# ============================================================================

# Family : Rotated Clayton (180 degrees)

fam2 <- 13

par0_3 <- 2

# Family : Rotated Clayton (90 degrees)

fam3 <- 23

par0_4 <- -2

# number of simulations

nb <- 200

# Simulation of shocks for the d risk factors

s0_par3 <- simshocks(n = nb, horizon = 4,

family = fam2, par = par0_3)

s0_par4 <- simshocks(n = nb, horizon = 4,

family = fam3, par = par0_4)

# Visualizing dependence between shocks

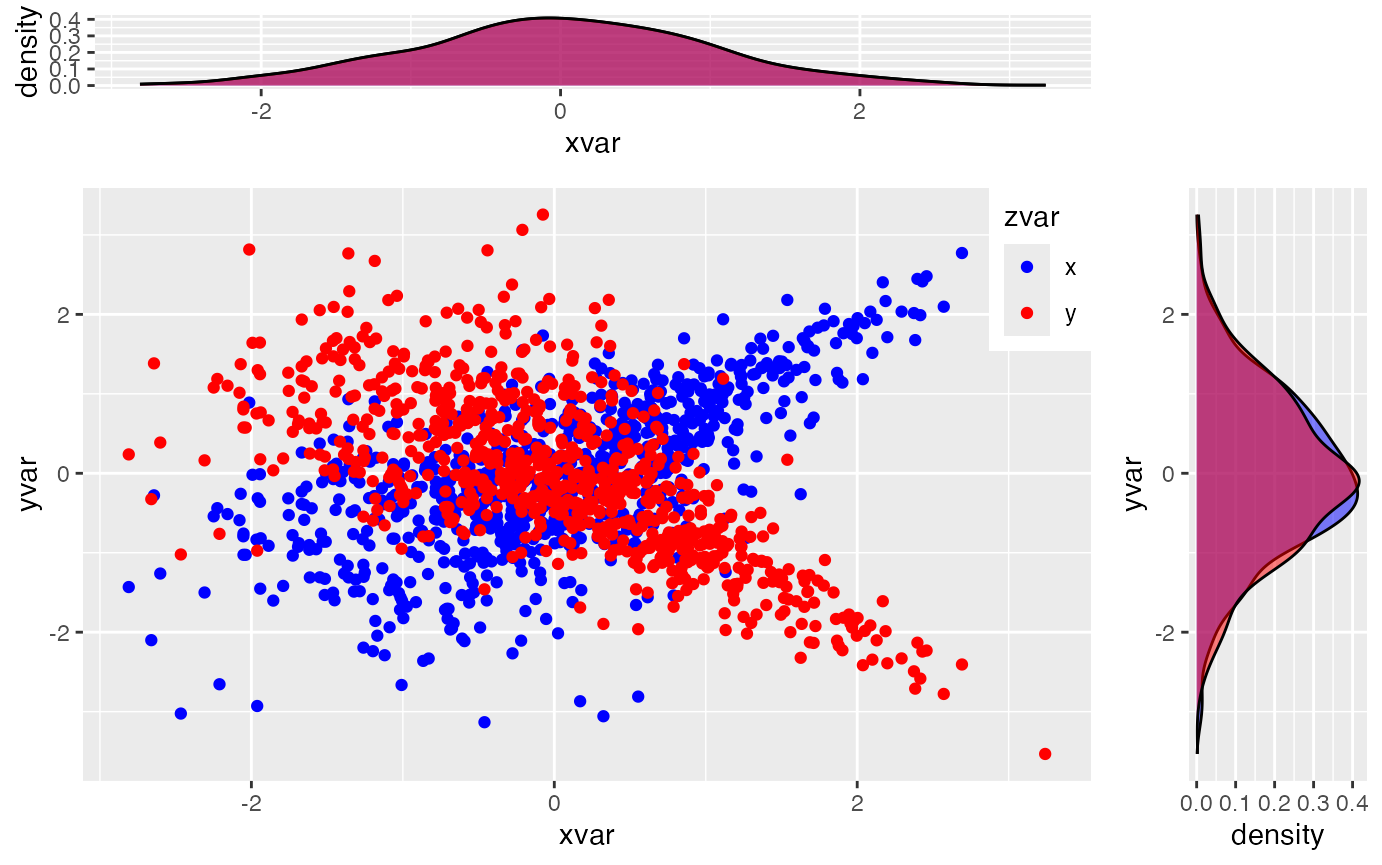

esgplotshocks(s0_par3, s0_par4)

# ============================================================================

# BATES MODEL (SVJD) - COMPLETE EXAMPLE

# ============================================================================

# Load required library for options pricing

#library(fOptions)

# ============================================================================

# BATES MODEL PARAMETERS

# ============================================================================

# Spot variance

V0 <- 0.1372

# mean-reversion speed

kappa <- 9.5110/100

# long-term variance

theta <- 0.0285

# volatility of volatility

volvol <- 0.8010/100

# Correlation between stoch. vol and prices

rho <- -0.5483

# Intensity of the Poisson process

lambda <- 0.3635

# mean and vol of the merton jumps diffusion

mu_J <- -0.2459

sigma_J <- 0.2547/100

m <- exp(mu_J + 0.5*(sigma_J^2)) - 1

# Initial stock price

S0 <- 4468.17

# Initial short rate

r0 <- 0.0357

# ============================================================================

# SIMULATION SETUP

# ============================================================================

n <- 300

horizon <- 1

freq <- "weekly"

# Simulation of shocks, with antithetic variates

shocks <- simshocks(n = n, horizon = horizon,

frequency = freq,

method = "anti",

family = 1, par = rho)

# ============================================================================

# VOLATILITY SIMULATION (CIR PROCESS)

# ============================================================================

# Vol simulation

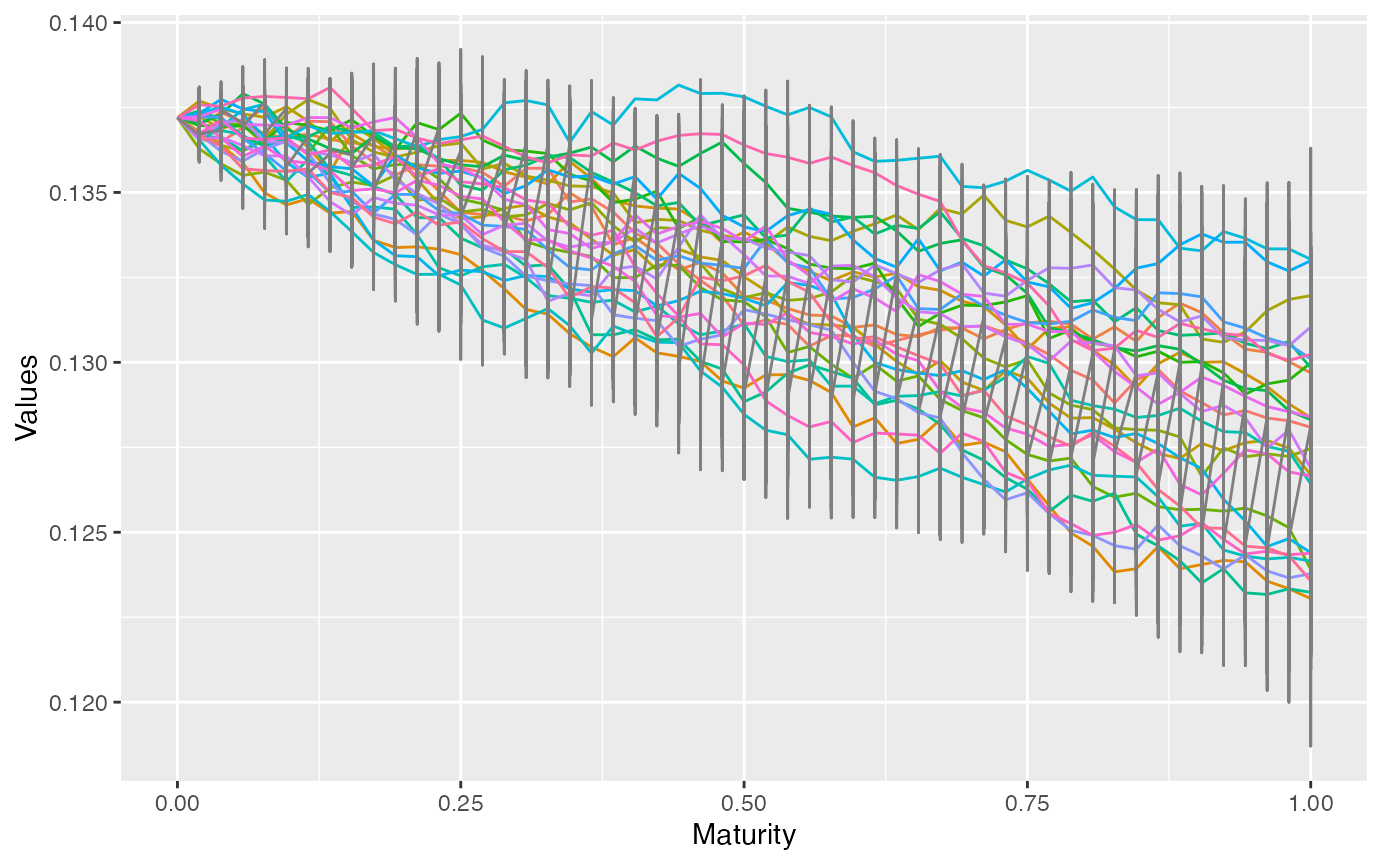

sim_vol <- simdiff(n = n, horizon = horizon,

frequency = freq, model = "CIR", x0 = V0,

theta1 = kappa*theta, theta2 = kappa,

theta3 = volvol,

eps = shocks[[1]])

# Plotting the volatility (only for a low number of simulations)

esgplotts(sim_vol)## Warning: Use of `meltdf$value` is discouraged.

## ℹ Use `value` instead.

# ============================================================================

# ASSET PRICE SIMULATION (GBM WITH JUMPS)

# ============================================================================

# prices simulation

sim_price <- simdiff(n = n, horizon = horizon,

frequency = freq, model = "GBM", x0 = S0,

theta1 = r0 - lambda*m, theta2 = sim_vol,

lambda = lambda, mu_z = mu_J,

sigma_z = sigma_J,

eps = shocks[[2]])

# ============================================================================

# VISUALIZATION OF PRICE PATHS

# ============================================================================

# Plot asset price paths

#par(mfrow=c(2, 1))

#matplot(time(sim_price), sim_price, type = 'l',

# main = "with matplot")

#esgplotbands(sim_price, main = "with esgplotbands", xlab = "time",

# ylab = "values")

# ============================================================================

# MARTINGALE TESTING

# ============================================================================

# Discounted Monte Carlo price

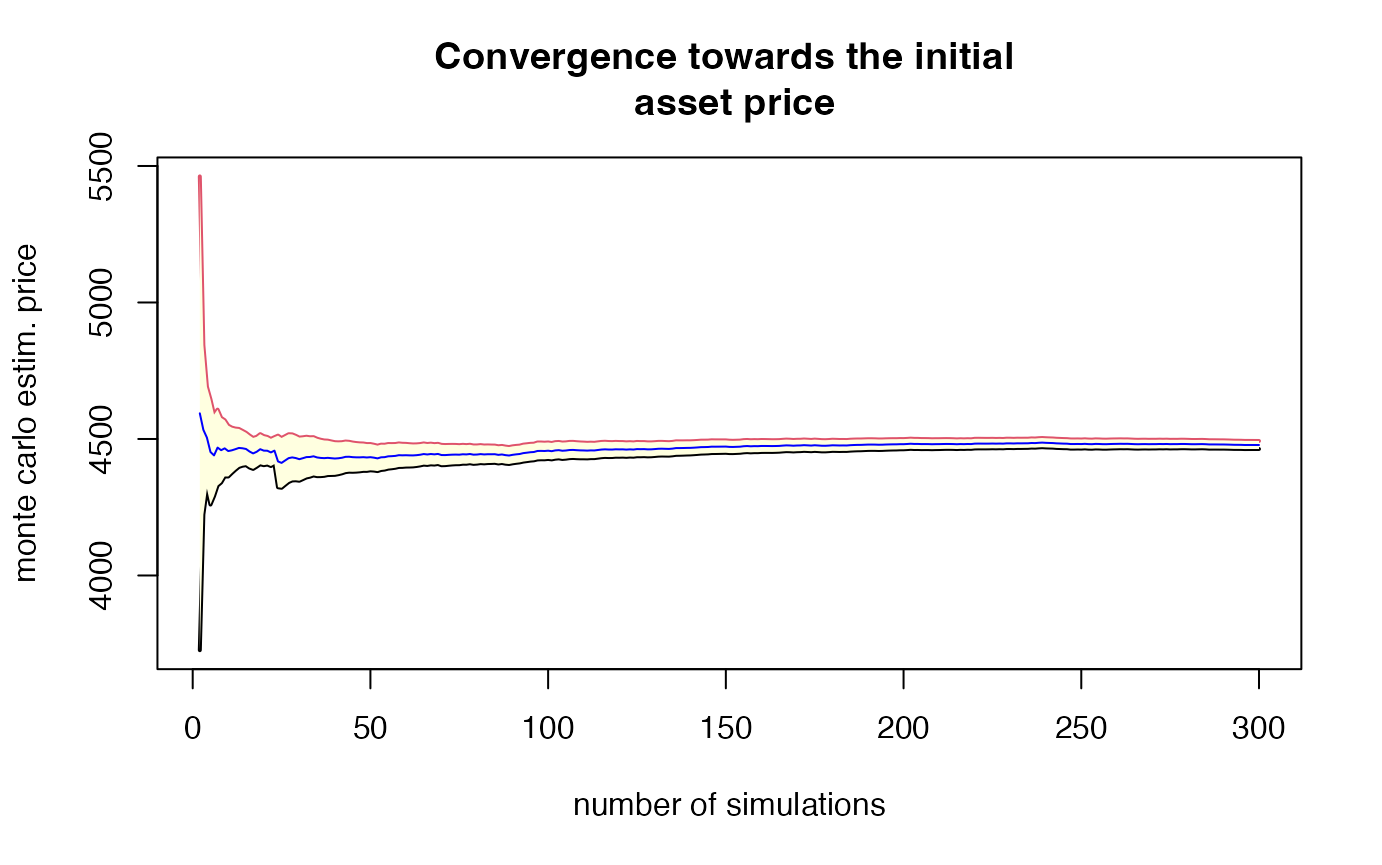

print(as.numeric(esgmcprices(r0, sim_price, 2/52)))## [1] 4477.961

# Initial price

print(S0)## [1] 4468.17

# pct. difference

print(as.numeric((esgmcprices(r0, sim_price, 2/52)/S0 - 1)*100))## [1] 0.219129

# convergence of the discounted price

esgmccv(r0, sim_price, 2/52,

main = "Convergence towards the initial \n asset price")

# Statistical martingale test

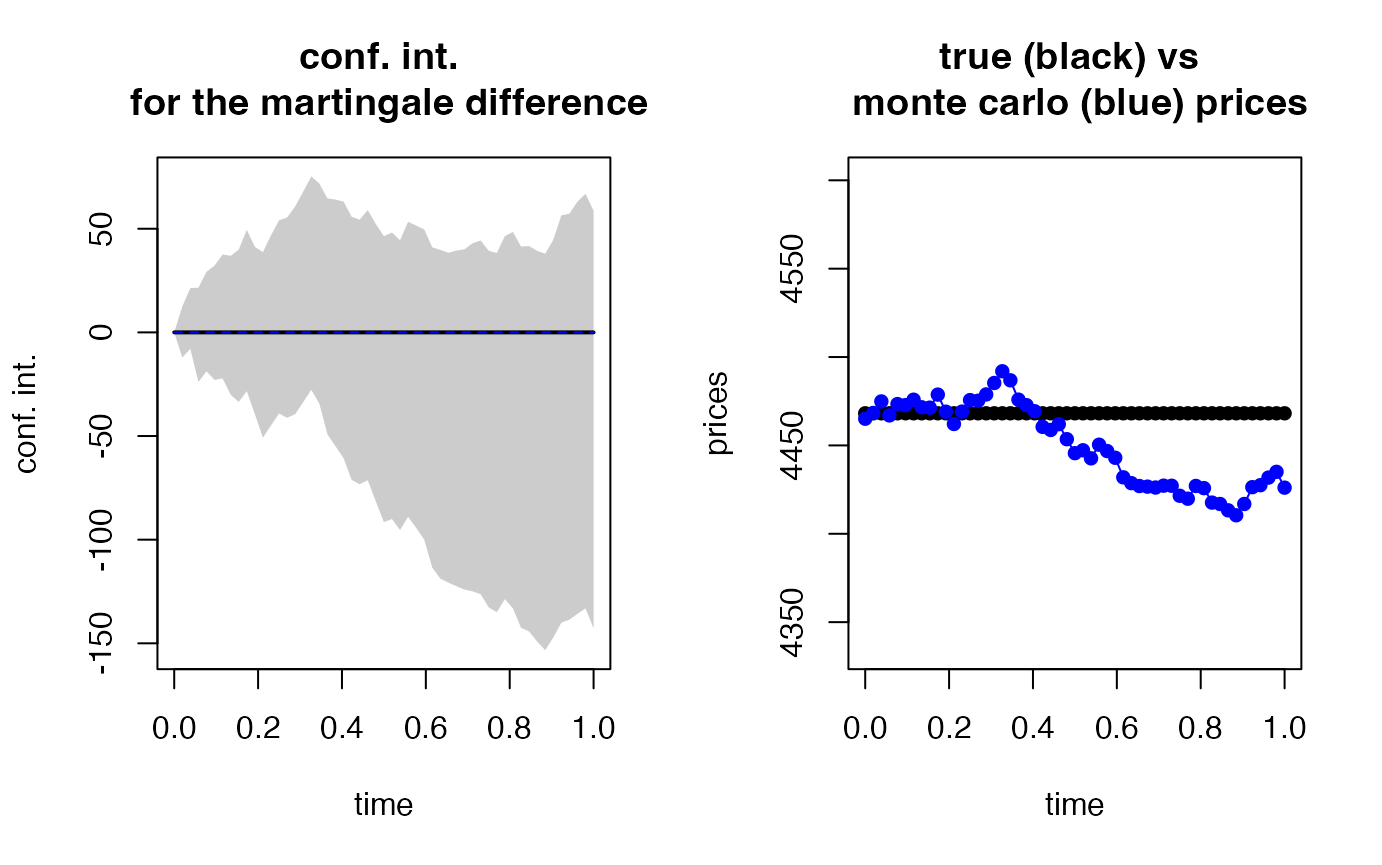

martingaletest_sim_price <- esgmartingaletest(r = r0,

X = sim_price,

p0 = S0)##

## martingale '1=1' one Sample t-test

##

## alternative hypothesis: true mean of the martingale difference is not equal to 0

##

## df = 299

## Time Series:

## Start = c(0, 2)

## End = c(1, 1)

## Frequency = 52

## t p-value

## 0.01923077 0.03080724 0.9754438

## 0.03846154 0.90140145 0.3681004

## 0.05769231 -0.10400871 0.9172322

## 0.07692308 0.42807917 0.6689017

## 0.09615385 0.33113992 0.7407708

## 0.11538462 0.50621254 0.6130805

## 0.13461538 0.20037467 0.8413238

## 0.15384615 0.17148936 0.8639550

## 0.17307692 0.53469593 0.5932575

## 0.19230769 0.04426928 0.9647193

## 0.21153846 -0.26545471 0.7908421

## 0.23076923 0.04090651 0.9673977

## 0.25000000 0.31530696 0.7527486

## 0.26923077 0.28963068 0.7722995

## 0.28846154 0.41918927 0.6753788

## 0.30769231 0.66484799 0.5066602

## 0.32692308 0.90912162 0.3640181

## 0.34615385 0.69208527 0.4894209

## 0.36538462 0.26716279 0.7895280

## 0.38461538 0.15193026 0.8793444

## 0.40384615 0.03782522 0.9698523

## 0.42307692 -0.23835143 0.8117718

## 0.44230769 -0.29068814 0.7714914

## 0.46153846 -0.18623124 0.8523897

## 0.48076923 -0.43102048 0.6667640

## 0.50000000 -0.64341435 0.5204484

## 0.51923077 -0.59591460 0.5516831

## 0.53846154 -0.71747470 0.4736414

## 0.55769231 -0.49192698 0.6231319

## 0.57692308 -0.57691371 0.5644318

## 0.59615385 -0.66160641 0.5087330

## 0.61538462 -0.92291886 0.3567936

## 0.63461538 -0.98082575 0.3274716

## 0.65384615 -1.01807391 0.3094659

## 0.67307692 -1.00857102 0.3139959

## 0.69230769 -1.00688520 0.3148041

## 0.71153846 -0.95961075 0.3380265

## 0.73076923 -0.94574071 0.3450445

## 0.75000000 -1.06788978 0.2864317

## 0.76923077 -1.09768435 0.2732255

## 0.78846154 -0.92409111 0.3561840

## 0.80769231 -0.91766652 0.3595331

## 0.82692308 -1.08137757 0.2804006

## 0.84615385 -1.08660542 0.2780864

## 0.86538462 -1.14634988 0.2525670

## 0.88461538 -1.18749897 0.2359734

## 0.90384615 -1.05287812 0.2932470

## 0.92307692 -0.83727931 0.4031043

## 0.94230769 -0.81738776 0.4143577

## 0.96153846 -0.72009854 0.4720269

## 0.98076923 -0.65207910 0.5148511

## 1.00000000 -0.82182713 0.4118301

##

## 95 percent confidence intervals for the mean :

## Time Series:

## Start = c(0, 1)

## End = c(1, 1)

## Frequency = 52

## c.i lower bound c.i upper bound

## 0.00000000 0.000000 0.00000

## 0.01923077 -12.090890 12.47547

## 0.03846154 -7.948449 21.38409

## 0.05769231 -23.924225 21.52229

## 0.07692308 -18.766510 29.20071

## 0.09615385 -22.931592 32.21020

## 0.11538462 -22.205702 37.58598

## 0.13461538 -30.093828 36.91686

## 0.15384615 -33.526519 39.92745

## 0.17307692 -28.337137 49.48059

## 0.19230769 -39.431995 41.24690

## 0.21153846 -50.778900 38.70798

## 0.23076923 -44.907748 46.81434

## 0.25000000 -39.116851 54.04320

## 0.26923077 -41.206132 55.42834

## 0.28846154 -39.426594 60.76936

## 0.30769231 -33.621004 67.92869

## 0.32692308 -27.694562 75.25318

## 0.34615385 -34.409095 71.73971

## 0.36538462 -49.181681 64.63296

## 0.38461538 -54.887861 64.07192

## 0.40384615 -60.720518 63.10046

## 0.42307692 -71.137961 55.76745

## 0.44230769 -73.252638 54.39715

## 0.46153846 -71.316782 58.98584

## 0.48076923 -81.536852 52.23732

## 0.50000000 -91.525272 46.42308

## 0.51923077 -90.036534 48.18213

## 0.53846154 -95.364637 44.40642

## 0.55769231 -88.916140 53.35289

## 0.57692308 -94.272631 51.52959

## 0.59615385 -100.008876 49.68326

## 0.61538462 -113.503066 41.03014

## 0.63461538 -118.827641 39.77788

## 0.65384615 -120.711405 38.39862

## 0.67307692 -122.448902 39.46662

## 0.69230769 -124.078557 40.08485

## 0.71153846 -124.911213 43.02258

## 0.73076923 -126.334385 44.32128

## 0.75000000 -132.674066 39.33434

## 0.76923077 -134.975736 38.31598

## 0.78846154 -128.634423 46.42898

## 0.80769231 -133.155007 48.46409

## 0.82692308 -142.469968 41.42156

## 0.84615385 -144.267330 41.62542

## 0.86538462 -149.135399 39.34349

## 0.88461538 -153.322895 37.92128

## 0.90384615 -147.232137 44.59900

## 0.92307692 -140.047214 56.44657

## 0.94230769 -138.576954 57.24252

## 0.96153846 -135.786167 63.03438

## 0.98076923 -133.100633 66.84731

## 1.00000000 -142.798528 58.66524

# Visualization of confidence intervals

esgplotbands(martingaletest_sim_price)

# ============================================================================

# OPTION PRICING EXAMPLE

# ============================================================================

# Option pricing parameters

# Strike

K <- 3400

Kts <- ts(matrix(K, nrow(sim_price), ncol(sim_price)),

start = start(sim_price),

deltat = deltat(sim_price),

end = end(sim_price))

# Implied volatility

sigma_imp <- 0.6625

# Maturity

maturity <- 2/52

# payoff at maturity

payoff_ <- (sim_price - Kts)*(sim_price > Kts)

payoff <- window(payoff_,

start = deltat(sim_price),

deltat = deltat(sim_price),

names = paste0("Series ", 1:n))

# True price (Black-Scholes)

c0 <- GBSOption("c", S = S0, X = K, Time = maturity, r = r0,

b = 0, sigma = sigma_imp)

print(c0@price)

# Monte Carlo price

print(as.numeric(esgmcprices(r = r0, X = payoff, maturity)))

# pct. difference

print(as.numeric((esgmcprices(r = r0, X = payoff,

maturity = maturity)/c0@price - 1)*100))

# Convergence towards the option price

esgmccv(r = r0, X = payoff, maturity = maturity,

main = "Convergence towards the call \n option price")

# ============================================================================

# ADDITIONAL UTILITY FUNCTIONS (Examples of usage)

# ============================================================================

# Time series windowing

# window.ts(sim_price, start = 0.25, end = 0.75)

# Get frequency of time series

# frequency(sim_price)

# Statistical testing with esgcortest

# esgcortest(shocks)

# Monte Carlo convergence visualization

# esgmccv(r0, sim_price, maturity)

# Plotting multiple shock series

# esgplotshocks(s0_par1, s0_par2)